- Shop

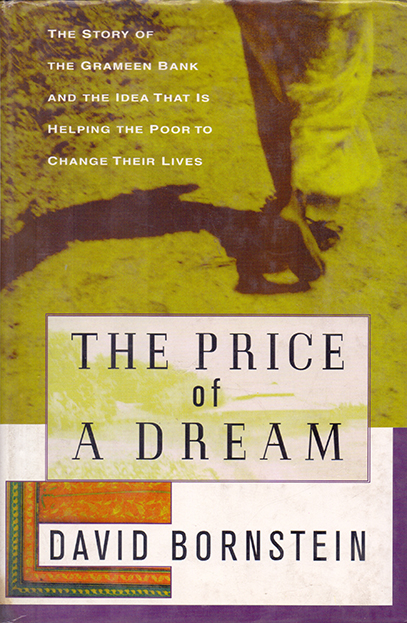

- The Price of a Dream: The Story of the Grameen Bank and the Idea that is Helping the Poor to Change their Lives

The Price of a Dream: The Story of the Grameen Bank and the Idea that is Helping the Poor to Change their Lives

https://uplbooks.com/shop/9789840513765-the-price-of-a-dream-the-story-of-the-grameen-bank-and-the-idea-that-is-helping-the-poor-to-change-their-lives-6491 https://uplbooks.com/web/image/product.template/6491/image_1920?unique=337f592

| Language: English |

Tags :

Book Info

One afternoon in 1976 an economics professor, taking a walk in a village in Bangladesh met a poor woman. The woman was trying to support herself by constructing and selling bamboo stools. She earned two cents a day. When the professor asked her why her profit was so low, she explained that the only person who would lend her money to buy bamboo was the trader who purchased her final product and the price he set barely covered her costs. The professor's instinct was to open his wallet and give her some money. Then he had another thought: Why not give her a loan? That thought became the genesis of a remarkable institution: the Grameen Bank. Today, the Grameen Bank is considered the most successful self-sustaining antipoverty program in the world. It has more than two million borrowers 94 percent of them women - and its approach has been replicated throughout the world, including in hundreds of locations across the United States and Canada. The Price of a Dream traces the history of Grameen Bank and its candid, vivid prose transports the reader to one of the world's most dramatic settings for a firsthand view of how this institution is helping millions of people change their lives. Since its independence in 1971, Bangladesh has received billions of foreign aid dollars and seen the majority of its citizens grow poorer. Against this backdrop, Mohammad Yunus, the founder of the Grameen Bank, reversed the conventional top-down development approach. In his view, development has to begin, not end, with a country's poorest citizens. In Bangladesh, this means landless women. In two decades, Yunus has shown that miracle cures are not required to alleviate poverty; instead, poverty can be addressed through innovative institutions that demonstrate faith in and respect for poor people.

David Bornstein

David Bornstein was born in Montreal, Canada. He studied commerce at McGill University and Journalism at New York University. He has written articles for The Atlantic Monthly, Details, New York Newsday, and The Village Voice. He lives in New York. This is his first book.